Food Safety Testing Market by Technology (Traditional and Rapid), Target Tested, Food Tested (Meat, Poultry, Seafood, Dairy, Processed Foods, Fruits & Vegetables, and Cereals & grains) and Region - Global Forecast to 2027

The global food safety testing market is estimated to reach $31.1 billion by 2027, growing at a 8.1% compound annual growth rate (CAGR). The global market size was valued $21.1 billion in 2022. The food safety testing market plays a critical role in ensuring the quality and safety of the food we consume. With its ability to detect and eliminate harmful contaminants, pathogens, and toxins from food products, this sector is essential in protecting public health. In light of rising public concern over food contamination and food-borne illnesses, combined with advancements in testing technologies, the food safety testing market is poised for significant growth.

The industry is highly regulated, and the food safety testing market covers a wide range of segments, including food type, technology, and geography. This sector employs both traditional methods like culture-based and immunoassays, as well as innovative techniques like DNA-based and rapid testing. With the expanding food industry and growing awareness about food safety, the food safety testing market is poised for continued success and growth. The development of cost-effective and innovative testing technologies will be key to its continued success, ensuring that we can have confidence in the food we eat.

To know about the assumptions considered for the study, Request for Free Sample Report

Food Safety Testing Market Dynamics

Driver: Rising food recalls due to non-compliant food products

A food recall occurs when a food manufacturer removes a product from the market because there is a possibility that it could make consumers ill. Government agencies may ask for or require a food recall in certain circumstances. There are several reasons for food recalls, including but not restricted to:

- Discovery of organisms, including bacteria like Salmonella and parasites like Cyclospora.

- Discovery of foreign items, such as metal or broken glass

- Discovery of a significant allergen that is not listed on the product label.

The massive increase in recalls has many causes, but some of them include the increasingly global and complex food supply chain, a few dramatic, large-scale recalls, like the intentional shipment of Salmonella-contaminated peanut products by the Peanut Corporation of America and the recall of over a half billion fresh eggs from Wright County Egg and Hillandale Farms, and the heightened regulatory oversight and media coverage that followed.

Food recalls are primarily a public health concern, but they are also significant economic issues. According to a joint industry study by the Food Marketing Institute and the Grocery Manufacturers Association, the average cost of a recall to a food company is $10M in direct costs, in addition to brand damage and lost sales. According to the Food Safety and Inspection Service (FSIS) of the U.S. Department of Agriculture, Russellville, Arkansas-based Conagra Brands, Inc. recently recalled about 119,581 pounds of frozen beef products because of misbranding and undeclared allergens. An allergy known as egg is included in the product but is not disclosed on the label.

Despite routine monitoring, outbreaks of foodborne illness are common and lead to product recalls. For example, the US FDA (Food and Drug Administration) reported 495 recalls in 2020 and 427 in 2021, and 585 food recalls in 2019. These outbreaks cause the food and beverage (F&B) industry to suffer massive loss and result in brand damage, decreased sales, and other fixed expenses for companies.

The number of food recalls and consumer complaints about fraudulent food manufacturing is increasing. Undeclared allergens in packaged foods cause serious health hazards for allergic consumers. The data on food recalls collected by various food safety organizations for undeclared allergens, undeclared ingredients, and economically motivated adulterations encourage the need for food testing in the products before and after they are packed.

Opportunity: Spike in food safety concerns after COVID-19

According to WHO, each year, unsafe food contributes to 420 000 deaths and 600 million cases of foodborne illness worldwide. Children under the age of five account for 30% of foodborne deaths. WHO estimated that 33 million healthy years of lives are lost due to eating unsafe food globally each year, and this number is likely an underestimation. The World Health Organization (WHO) estimates that the global burden of Food Borne Diseases (FBDs) is comparable to that of malaria, HIV/AIDS, or tuberculosis. Low- and middle-income countries account for 98% of the global FBD burden. Africa has the highest per capita burden, and Asia has the highest total burden. COVID-19 has broadly changed consumer perceptions about food safety. Though the novel coronavirus is typically transmitted via airborne respiratory droplets, and the risk of contracting it through contaminated food is considered low, people around the world are demonstrably more concerned about disease risk from food. This new awareness and demand for better food hygiene can pressure value chain participants to deliver food safety. Both the USDA and FDA have taken action in response to the COVID-19 crisis. The most pressing challenges when it comes to the pandemic's impacts on food safety are supply chain management, recalls, and inspections.

Numerous aspects of food safety, such as transportation and dining etiquette, have improved since the COVID-19 outbreak. Due to the lockdown, a new business opportunity in the food industry emerged with the use of information technology (IT) to track down customer information and smartphone apps for food order and delivery using a drone and robotic technologies. This crisis presents an opportunity to alter the food system in ways that are less prone to disruption. Consumers are more conscious than ever of food safety and technology that maintain food safety.

In response to the COVID-19 pandemic, a survey from global software and engineering leader, Emerson, headquartered in the US, finds that food quality and the technologies that keep food safe have become increasingly important to consumers. After surveying nearly 1,000 U.S. consumers on their perception and expectation of food safety practices, Emerson found customers consider the guaranteed quality and freshness of their foods; proper storage of refrigerated and frozen foods; and whether stores use the latest technology to keep food safe during transportation as some of the most important factors driving their food shopping decisions.

- Nearly 2 out of 3 consumers (62%) agree better technology can help keep food safe to eat.

- More than half (56%) of consumers say better data is needed to follow adequate food safety practices from farm to table.

- Over 5 out of 10 (51%) consumers said they’d be less likely to purchase goods from retailers that aren’t using – and having suppliers use – the latest technologies available to keep their food safe.

- Half of consumers (51%) concern about the safety of fresh, perishable, and frozen foods during their transportation to stores.

According to Emerson's survey, many consumers have changed their buying patterns and frequency of shopping due to safety concerns about COVID-19. Additionally, more than half (52%) of customers believe they are now more concerned about the safety of their food. The critical goal of providing consumers across the nation with higher-quality, safer food has been highlighted by the challenges and behaviour changes brought on by COVID-19.

Restraint: Lack of coordination between market stakeholders and improper enforcement of regulatory laws and supporting infrastructure

The food industry in developing countries remains highly fragmented and is predominated by small and unorganized players, who may have not necessarily adopted proper food testing practices, leading to a greater risk of contamination. Food control systems may be fragmented among national, state, and local organisations, and the effectiveness of their implementation depends on the strength and efficiency of the agency responsible at each level. As a result, consumers would not be protected to the same extent across the nation, and it might be challenging to evaluate the effectiveness of interventions by national, state or local authorities. Testing food & beverage products, such as packaged foods, dairy products, beverages, and meat products, requires proper enforcement measures, coordination between market stakeholders, and supporting infrastructure. However, many countries that are classified in the cluster of developing economies lack these factors, acting as a restraint to the food safety testing industry in these regions.

Several factors, such as lack of institutional coordination, technical skills, and expertise for the implementation of legislation at grassroot levels, equipment, and, in certain countries, updated standards, inhibit the market for food testing. Further, the lack of basic supporting infrastructure in setting up testing laboratories also acts as a restraint in the growth of the testing market, especially in developing countries.

Food safety is a shared responsibility. Everyone has a role in ensuring that food is safe, including regulators, food industry professionals, academic institutions, research organisations, and consumers. In order to safeguard the public from harmful or dishonest practises, regulatory frameworks on food safety are required. These frameworks must define what is acceptable, provide procedures to monitor compliance, and sanction non-compliance. Minimizing food safety risk requires that operators of food businesses must continually do their part to provide safe food and minimize foodborne risk. Regular interaction and consultation between industry and regulators leads to improved acceptance of, and compliance with, food standards.

The food control responsibilities are shared between Government Ministries such as Health, Agriculture, Commerce, Environment, Trade and Industry, and Tourism, and the roles and responsibilities of each of these organisations are well defined but quite distinct. This can occasionally result in issues like regulatory duplication, increased bureaucracy, fragmentation, and a lack of coordination between the various organisations in charge of regulating, monitoring, and controlling food safety. For instance, the supervision and regulation of meat and meat products may be distinct from the food control activities carried out by a Ministry of Health. The data produced may not be linked to public health and food safety monitoring programmes because meat inspection is usually carried out by Ministry of Agriculture or primary industry workers who also perform all veterinary activities. The lack of these has been acting as a bottleneck in the growth of this market in some developing regions.

Challenge: High cost associated with the procurement of food safety testing equipment

For toxicity and contaminant detection in various agricultural and food products, analytical techniques such thin-layer chromatography, high-performance liquid chromatography, gas chromatography, and gas chromatography combined with mass spectrometry have traditionally been used. These methods are reliable, but the initial costs and equipment space requirements are high. Furthermore, an increased focus on R&D activities, coupled with the necessity for accuracy and reliability of readings, is increasing the price of these instruments. Since most of these testing instruments are exported in large quantities from developed countries in North America and Europe, it adds to the cost of procuring these technologies, especially in developing economies.

The cost of lab testing is one of the main challenges faced by importers and exporters when it comes to product compliance. The price of third-party lab testing can range from $100 to $100,000, depending on the number of applicable regulations, the tests that must be performed, and the number, material, and colour of the products. Technologies, being export-oriented commodities, have export or import duties levied on them, making them more expensive. The price of this testing equipment also differs in different parts of the world, having margins varying from 10% to 30% based on the origin of manufacturing. Additionally, consumables used for testing techniques are expensive, further increasing by added labor costs.

Automated testing instruments are equipped with advanced features and functionalities and are thus priced at a premium. For example, the price for spectroscopy-based systems ranges from USD 150,000 to USD 850,000. The estimated cost for the instrument, media, and labor is also very high for some end users. Installing and using in-line spectroscopic technologies for quality assurance and control has a large initial cost. It comprises not only the cost of the hardware but also the cost of developing a robust statistical model for a particular supplier's product. Testing laboratories require many such systems, owing to which the entire capital cost investment increases significantly. Academic research laboratories generally cannot afford such systems as they have limited budgets. In addition, the maintenance costs and several other indirect expenses result in an overall increase in the total cost of ownership of these instruments. These factors highly hinder the mass adoption of automated testing technologies in the food safety testing industry.

The expense of food safety testing and a lack of adequate infrastructure are the major barriers to market growth. Food safety testing are the backbone of the whole public health surveillance system. To test food for numerous disease-causing pathogens, a suitable infrastructure for food safety testing is required. Developing countries suffer greatly from the lack of such infrastructure for food safety. To operate different systems, including PCR equipment and other systems, good expertise and skilled technicians are also necessary. Additionally, developing countries with weak economies and inadequate scientific infrastructure cannot afford the price of various food safety testing equipment, which is hindering the growth of the market.

The GMOS, by target tested is projected to account for the highest CAGR during the forecast period.

GM foods have been in greater demand among consumers due to the enhanced nutrition they offer. Globally, the food market is shifting and companies are working to meet demand by creating GM foods that are high-quality and nutrient-rich. Rising demand for high-quality foods as well as consumer awareness of food safety and the health benefits of nutrients is primarily driving the growth of the global genetically modified food safety testing market.

The processed food, by food tested segment is projected to account for the second largest market share in the Food safety testing market during the forecast period.

The increase in consumption of processed food in the form of convenience food, both in developing and developed countries, is creating a significant opportunity for convenience food testing. Ready-to-eat or minimally processed foodstuffs of plant and animal origins have become very popular among consumers. This is mainly because of their fast-paced lifestyle, changing tastes and preferences, and modernization of food technologies.

The PCR based testing, by Rapid technology segment is estimated to account for the largest market share in the Food safety testing market during the forecast period.

Nowadays, any food producer can now set up a PCR laboratory almost next to the production line and utilize the same food production staff to do the testing; this is mainly because of recent developments in closed-tube and automated PCR and the accessibility of reasonably inexpensive kits and equipment. Furthermore, the automation of PCR setup enhances throughput and reproducibility while greatly reducing hands-on time and therefore supported the growth of market.

To know about the assumptions considered for the study, download the pdf brochure

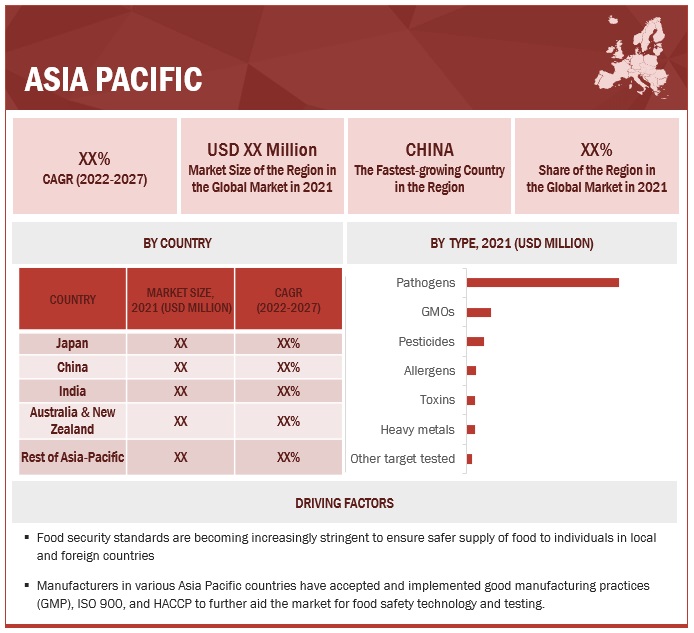

APAC is projected to account for the highest CAGR in the Food safety testing market during the forecast period.

The Asia Pacific food safety market is growing owing to the implementation of stringent rules and regulation regarding food. Governments have put different regulations in place for consumers, producers, and regulators. The market growth in this region is largely driven by rising demand for processed food in emerging and developing nations like India, China, Indonesia, and Thailand, as well as an increase in poisoning outbreaks caused by consumption of contaminated meat and rise in cases of food degradation like contamination, pesticides, and artificial flavouring. In 2007, the APEC Food Safety Cooperation Forum (FSCF), led by China and Australia, was established to improve the technical competence of food safety management and detection practices throughout the food supply chain.

Key Food Safety Testing Companies

The key players in this market include SGS SA (Switzerland), Eurofins Scientific (Luxembourg), Intertek Group plc (UK), Bureau Veritas (France), ALS Limited (Australia), TÜV SÜD (Germany), Mérieux NutriSciences (US), AsureQuality (New Zealand), FoodChain ID (US), R J Hill Laboratories Limited (New Zealand), Microbac Laboratories, Inc. (US), and Symbio Laboratories (Australia). These players in this market are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific, and Europe. They also have laboratory facilities along with strong distribution networks across these regions.

Food Safety Testing Market Report Scope

|

Report Metric |

Details |

|

Market magnitude in 2022 |

USD 21.1 billion |

|

Financial outlook in 2027 |

USD 31.1 billion |

|

Expansion rate |

CAGR of 8.1% |

|

Base year for estimation |

2021 |

|

Forecast period |

2022-2027 |

|

Quantitative units |

Value (USD Million) and Volume (Thousand Units) |

|

Report Coverage & Deliverables |

Revenue forecast, company ranking, driving factors, Competitive benchmarking, and analysis |

|

Segments covered |

Technology, Region, Target Tested, Food Tested |

|

Regional Insight |

Europe, North America, South America, Asia Pacific |

|

Research coverage |

This report segments the Food safety testing market on the basis of food tested, target tested, technology and region. In terms of insights, this research report focuses on various levels of analyses—competitive landscape, end-use analysis, and company profiles—which together comprise and discuss the basic views on the emerging & high-growth segments of the Food safety testing market, the high-growth regions, countries, government initiatives, market disruption, drivers, restraints, opportunities, and challenges. |

This research report categorizes the Food safety testing market based on food tested, target tested, technology and Region

Based on Food tested (Revenue, USD billion, 2022 - 2027)

- Meat, poultry, and seafood

- Dairy products

- Processed food

- Fruits & vegetables

- Cereals & grains

- Other food products tested

Based on target tested

-

Pathogens

- E. coli

- Salmonella

- Campylobacter

- Listeria

- Others

- Pesticides

- GMOs

- Mycotoxin

- Allergens

- Heavy metals

- Other targets tested

Based on the technology

- Traditional

-

Rapid

- Convenience-based

- Polymerase chain reaction (PCR)

- Immunoassay

- Chromatography & spectrometry

Based on the region

- North America

- Europe

- Asia Pacific

- RoW (South America, Middle East & Africa)

Recent Developments

- In July 2021, Intertek Group plc acquired Brazil-based JLA Brasil Laboratório de Análises de Alimentos S.A. ('JLA'), one of the leading providers of food, agriculture and environmental testing solutions based in Brazil. This acquisition will help Intertek to enhance its food safety testing service portfolio for the Brazilian customers.

- In May 2021, Eurofins Scientific acquired UK-based Eurofins Scientific Alliance Technical Laboratories (ATL) Ltd. This acquisition to enhance company’s food, water, and feed testing service facility in the UK.

- In May 2020, Bureau Veritas, in collaboration with Leela Palaces (India), has launched the “Surakhsha” initiative to provide high standards of food safety and hygiene and leverage technological services for maintaining the hygiene standards. This collaboration will strengthen Bureau Veritas’ service portfolio in food safety testing service market.

- In Jan 2020, ALS acquired Spain-based independent food testing business, Aquimisa Group. This acquisition will support the company enhance its presence in Europe and is in line with the company's focus on food and pharmaceutical opportunities the global markets.

Frequently Asked Questions (FAQ):

How big is the food safety testing market?

The food safety testing market is expected to grow significantly, from US$ 21.1 billion in 2022 to US$ 31.1 billion by 2027, with a compound annual growth rate (CAGR) of 8.1%. This indicates the sector's vital role in guaranteeing food quality and safety.

Which players are involved in the manufacturing of food safety testing market?

The key players in this market include Corteva Agriscience (US), BASF (Germany), Bayer (Germany), and Syngenta (Switzerland). Some emerging players in the global market include Nufarm (Australia), ADAMA (Israel), Arysta LifeScience (US), Drexel Chemical Company (US), Winfield United (US), Sipcam-Oxon (Italy), Helm AG (Germany), Tenkoz (US), Rainbow Agro (China), and Helena Agri Enterprise (US).

Is there Oceania (New Zealand and Australia) specific information (market size, players, growth rate) for the food safety testing market?

On request, We will provide details on the market size, key players, growth rate of this industry in the Oceania region. Also, you can let us know if there are any other countries of your interest.

What is the future growth potential of the food safety testing market?

The future growth potential of the food safety testing market is substantial, driven by several key factors that reflect evolving consumer preferences, regulatory standards, and technological advancements. Firstly, there is a growing global awareness of foodborne illnesses and outbreaks, leading to increased demand for stringent food safety regulations and testing protocols. Governments and regulatory bodies worldwide are imposing stricter standards on food safety, mandating regular testing of food products to ensure they meet safety requirements. This regulatory landscape creates a conducive environment for the growth of the food safety testing market. Secondly, advancements in food safety testing technologies are expanding the capabilities and efficiency of testing methods. Techniques such as PCR (Polymerase Chain Reaction), ELISA (Enzyme-Linked Immunosorbent Assay), and rapid microbiological testing enable faster and more accurate detection of contaminants, pathogens, and adulterants in food products. Additionally, the development of portable and on-site testing devices allows for real-time monitoring of food safety throughout the supply chain, from farm to fork.

What are the key development strategies undertaken by companies in the Food safety testing market?

Strategies such as new product launches, investments into expansion and development, research initiatives are the key strategies being used by large players in order to achieve differential positioning in the global market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 49)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 FOOD SAFETY TESTING: MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.4 INCLUSIONS & EXCLUSIONS

1.5 YEARS CONSIDERED

1.6 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED FOR THE STUDY, 2018–2021

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 55)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primaries

2.1.2.2 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP

2.2.2 TOP-DOWN

2.2.3 SUPPLY-SIDE

FIGURE 3 DATA TRIANGULATION: SUPPLY-SIDE

2.2.4 DEMAND-SIDE

FIGURE 4 DATA TRIANGULATION: DEMAND-SIDE

2.3 DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION METHODOLOGY

2.4 RESEARCH ASSUMPTIONS

2.5 RESEARCH LIMITATIONS & ASSOCIATED RISKS

3 EXECUTIVE SUMMARY (Page No. - 66)

TABLE 2 FOOD SAFETY TESTING MARKET SNAPSHOT, 2022 VS. 2027

FIGURE 6 MARKET SIZE, BY TARGET TESTED, 2022 VS. 2027 (USD MILLION)

FIGURE 7 MARKET SIZE, BY FOOD TESTED, 2022 VS. 2027 (USD MILLION)

FIGURE 8 MARKET SIZE, BY TECHNOLOGY, 2022 VS. 2027 (USD MILLION)

FIGURE 9 MARKET SHARE, BY REGION, 2021

4 PREMIUM INSIGHTS (Page No. - 71)

4.1 OPPORTUNITIES FOR PLAYERS IN FOOD SAFETY TESTING MARKET

FIGURE 10 INCREASING AWARENESS AMONG CONSUMERS ABOUT FOOD SAFETY AND HEALTH CONCERNS

4.2 FOOD SAFETY TESTING MARKET, BY TECHNOLOGY

FIGURE 11 RAPID TESTING TO BE PREFERRED TECHNOLOGY

4.3 FOOD SAFETY TESTING MARKET, BY FOOD TESTED

FIGURE 12 MEAT, POULTRY, AND SEAFOOD TO BE LARGEST SEGMENT

4.4 FOOD SAFETY TESTING MARKET, BY TARGET TESTED

FIGURE 13 PATHOGENS TO BE MOST TESTED CONTAMINANTS

4.5 ASIA PACIFIC: FOOD SAFETY TESTING MARKET, BY KEY COUNTRY AND TARGET TESTED

FIGURE 14 CHINA WAS MAJOR CONSUMER IN ASIA PACIFIC IN 2021

4.6 FOOD SAFETY TESTING MARKET, BY TARGET TESTED AND REGION

FIGURE 15 EUROPE TO ACCOUNT FOR LARGEST SHARE OF FOOD SAFETY TESTING, 2022 VS. 2027

4.7 FOOD SAFETY TESTING MARKET: MAJOR REGIONAL SUBMARKETS

FIGURE 16 US ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

5 MARKET OVERVIEW (Page No. - 76)

5.1 INTRODUCTION

5.2 MACROECONOMIC INDICATORS

5.2.1 INCREASE IN GLOBAL OUTBREAKS OF FOODBORNE ILLNESSES

FIGURE 17 FIVE PATHOGENS ACCOUNTED FOR MOST FOODBORNE ILLNESSES COST IN US

FIGURE 18 BURDEN OF FOODBORNE ILLNESS ACROSS REGIONS, 2020

5.2.2 INCREASED GLOBAL FOOD TRADE

FIGURE 19 GLOBAL AGRI-FOOD EXPORT, 2018–2020 (USD BILLION)

FIGURE 20 COUNTRY-WISE PREPARED FOODS TRADE SCENARIOS, 2021 (USD THOUSAND)

5.3 MARKET DYNAMICS

FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN FOOD SAFETY TESTING MARKET

5.3.1 DRIVERS

5.3.1.1 Cross-contamination of food products due to complex processes

5.3.1.2 Stringent food safety regulations

5.3.1.3 Availability of advanced rapid technology

5.3.1.4 Increase in demand for convenience and packaged food products

FIGURE 22 RISING GLOBAL MEAT EXPORTS, 2017–2020 (KILOTON)

5.3.1.5 Rising food recalls due to non-compliant food products

FIGURE 23 RECALLED PRODUCTS BY FISCAL YEARS, 2012–2022

TABLE 3 FOOD RECALL BY REASONS IN THE US, 2021

TABLE 4 LIST OF FOOD RECALLS, 2020–2021

FIGURE 24 CATEGORY-WISE FDA FOOD RECALLS, 2019

5.3.1.6 Rise in consumer awareness about food safety

FIGURE 25 FOOD SAFETY AWARENESS AMONGST CONSUMERS IN THE US, 2019

FIGURE 26 CONSUMER CHECKS FOR LABEL AND NUTRITIONAL INFORMATION PANEL (NIP) ON FOOD PRODUCTS (% OF CONSUMERS)

5.3.2 RESTRAINTS

5.3.2.1 Lack of coordination between market stakeholders and improper enforcement of regulatory laws and supporting infrastructure

5.3.2.2 Complexity in testing techniques

5.3.2.2.1 Difficulties in detection of unknown adulterants by chemical tests

5.3.2.2.2 Varying test results with test methods

5.3.3 OPPORTUNITIES

5.3.3.1 Technological advancements in testing industry

TABLE 5 TOP FOOD TESTING TECHNOLOGY INNOVATIONS

5.3.3.2 Spike in food safety concerns after COVID-19

5.3.4 CHALLENGES

5.3.4.1 Lack of harmonization of food safety standards

5.3.4.2 High cost associated with procurement of food safety testing equipment

6 INDUSTRY TRENDS (Page No. - 98)

6.1 INTRODUCTION

6.2 SUPPLY CHAIN ANALYSIS

6.2.1 UPSTREAM PROCESS

6.2.1.1 R&D

6.2.1.2 Production

6.2.2 MIDSTREAM PROCESS

6.2.2.1 Processing & transforming

6.2.2.2 Transportation

6.2.3 DOWNSTREAM PROCESS

6.2.3.1 Final preparation

6.2.3.2 Distribution

FIGURE 27 SUPPLY CHAIN ANALYSIS

FIGURE 28 FOOD SAFETY MANAGEMENT SYSTEM (FSMS)

6.3 VALUE CHAIN ANALYSIS

6.3.1 INPUT MARKET

6.3.2 FOOD MARKET

6.3.3 DISTRIBUTION

FIGURE 29 VALUE CHAIN ANALYSIS: FOOD DEALERS ADD 2% TO 7% TO THE PRICE OF THE END PRODUCTS

6.4 TECHNOLOGY ANALYSIS

6.4.1 FOURIER TRANSFORM INFRARED (FTIR)

6.4.2 MICROARRAY

6.4.3 PHAGE

6.4.4 BIOCHIP

6.4.5 BIOSENSOR

6.4.6 FLOW CYTOMETRY

6.4.7 NMR

6.4.8 NIRS

6.4.9 ICP

6.5 PATENT ANALYSIS

FIGURE 30 PATENTS GRANTED FOR FOOD SAFETY TESTING MARKET, 2011–2021

FIGURE 31 REGIONAL ANALYSIS OF PATENTS GRANTED FOR FOOD SAFETY TESTING MARKET, 2011–2021

TABLE 6 KEY PATENTS FOR FOOD SAFETY TESTING MARKET, 2020–2022

6.6 MARKET MAP

FIGURE 32 FOOD SAFETY TESTING: MARKET MAP

6.6.1 MANUFACTURERS

6.6.2 SERVICE PROVIDERS

6.6.3 TECHNOLOGY PROVIDERS

6.6.4 FOOD SAFETY AUTHORITIES

TABLE 7 FOOD SAFETY TESTING MARKET: ECOSYSTEM

6.7 PORTER’S FIVE FORCES ANALYSIS

TABLE 8 FOOD SAFETY TESTING MARKET: PORTER’S FIVE FORCES ANALYSIS

6.7.1 DEGREE OF COMPETITION

6.7.2 BARGAINING POWER OF BUYERS

6.7.3 BARGAINING POWER OF SUPPLIERS

6.7.4 THREAT OF SUBSTITUTES

6.7.5 THREAT OF NEW ENTRANTS

6.8 TRADE SCENARIO

FIGURE 33 MEAT & MEAT PRODUCTS: IMPORT VALUE, BY KEY COUNTRY, 2017–2021 (USD THOUSAND)

TABLE 9 IMPORT DATA OF MEAT AND MEAT PRODUCTS FOR KEY COUNTRIES, 2021 (VALUE AND VOLUME)

FIGURE 34 MEAT & MEAT PRODUCTS: EXPORT VALUE, BY KEY COUNTRY, 2017–2021 (USD THOUSAND)

TABLE 10 EXPORT DATA OF MEAT AND MEAT PRODUCTS FOR KEY COUNTRIES, 2021 (VALUE AND VOLUME)

FIGURE 35 EU TRADE IN AGRICULTURAL PRODUCTS, 2017–2021 (EURO BILLION)

FIGURE 36 FRUITS & NUTS: IMPORT VALUE, BY KEY COUNTRY, 2017–2021 (USD THOUSAND)

TABLE 11 IMPORT DATA OF FRUITS AND NUTS FOR KEY COUNTRIES, 2021 (VALUE AND VOLUME)

FIGURE 37 FRUITS & NUTS: EXPORT VALUE, BY KEY COUNTRY, 2017–2021 (USD THOUSAND)

TABLE 12 EXPORT DATA OF FRUITS AND NUTS FOR KEY COUNTRIES, 2021 (VALUE AND VOLUME)

FIGURE 38 DAIRY PRODUCTS: IMPORT VALUE, BY KEY COUNTRY, 2017–2021 (USD THOUSAND)

TABLE 13 IMPORT DATA OF DAIRY PRODUCTS FOR KEY COUNTRIES, 2021 (VALUE)

FIGURE 39 DAIRY PRODUCTS: EXPORT VALUE, BY KEY COUNTRY, 2017–2021 (USD THOUSAND)

TABLE 14 EXPORT DATA OF DAIRY PRODUCTS FOR KEY COUNTRIES, 2021 (VALUE)

6.9 KEY CONFERENCES & EVENTS IN 2022–2023

TABLE 15 FOOD SAFETY TESTING MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2022–2023

6.10 TARIFF AND REGULATORY LANDSCAPE

6.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 16 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 17 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 18 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 19 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6.10.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSES

FIGURE 40 REVENUE SHIFT FOR FOOD SAFETY TESTING SERVICES

6.11 CASE STUDY ANALYSIS

6.11.1 FOOD TEST QUALITY, ACCURACY, AND TURN-AROUND TIME PLAY CRUCIAL ROLES IN DETERMINING OVERALL FOOD SAFETY

6.11.2 SUNSHINE MILLS, INC. BEGAN USING BARROW-AGEE LABORATORIES AS ITS GO-TO LAB FOR ALL OF ITS QUALITY TESTING NEEDS

6.12 KEY STAKEHOLDERS AND BUYING CRITERIA

6.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 41 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TECHNOLOGIES

TABLE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TECHNOLOGIES (%)

6.12.2 BUYING CRITERIA

TABLE 21 KEY CRITERIA FOR SELECTING SUPPLIER/VENDOR

FIGURE 42 KEY CRITERIA FOR SELECTING SUPPLIER/VENDOR

7 REGULATIONS FOR FOOD SAFETY TESTING MARKET (Page No. - 127)

7.1 INTRODUCTION

7.2 INTERNATIONAL BODY FOR FOOD SAFETY STANDARDS AND REGULATIONS

7.2.1 CODEX ALIMENTARIUS COMMISSION (CAC)

7.2.2 GLOBAL FOOD SAFETY INITIATIVE (GFSI)

7.3 NORTH AMERICA

7.3.1 US REGULATIONS

7.3.1.1 Federal legislation

7.3.1.1.1 State legislation

7.3.1.1.2 Food safety in retail food

7.3.1.1.3 Food safety in trade

7.3.1.1.4 HACCP regulation in the US

7.3.1.1.5 US regulation for foodborne pathogens in poultry

7.3.1.1.6 Food safety regulations for fruit & vegetable growers

7.3.1.1.7 GMO regulations in the US

7.3.1.1.8 FDA Food Safety Modernization Act (FSMA)

7.3.1.1.9 Labeling of GM foods

TABLE 22 FEDERAL FOOD, DRUG, AND COSMETIC ACT, BY TOLERANCE OF RAW & PROCESSED FOOD

7.3.1.1.10 Regulatory guidance by FDA for aflatoxins

7.3.1.1.11 Pesticide regulation in the US

7.3.2 CANADA

7.3.3 MEXICO

7.4 EUROPE

7.4.1 EUROPEAN UNION REGULATIONS

FIGURE 43 LEGISLATION PROCESS IN THE EU

7.4.1.1 Microbiological criteria regulation

7.4.1.2 Melamine legislation

TABLE 23 MAXIMUM LEVEL FOR MELAMINE & ITS STRUCTURAL ANALOGS

7.4.1.3 General food law for food safety

FIGURE 44 ROLE OF EFSA IN REDUCING CAMPYLOBACTERIOSIS

7.4.1.4 GMOs regulation

TABLE 24 GMOS: LABELING REQUIREMENT

7.4.1.5 Regulations on mycotoxins

7.4.1.5.1 Ochratoxin A

TABLE 25 COMMISSION REGULATION FOR OCHRATOXIN A

7.4.1.5.2 Dioxins and PBCs

7.4.1.5.3 Fusarium toxins

7.4.1.5.4 Aflatoxins

7.4.1.5.5 Polycyclic Aromatic Hydrocarbons (PAH)

7.4.2 GERMANY

7.4.3 UK

7.4.3.1 Mycotoxins regulations

TABLE 26 MAXIMUM LEVELS OF VARIOUS TYPES OF MYCOTOXINS IN DIFFERENT FOODS

7.4.4 FRANCE

7.4.5 ITALY

7.4.6 POLAND

7.5 ASIA PACIFIC

7.5.1 CHINA

7.5.1.1 Regulating bodies for food safety

7.5.1.2 Major efforts of China to standardize its food safety system

7.5.2 JAPAN

7.5.3 INDIA

7.5.3.1 Food safety standards amendment regulations, 2012

7.5.3.2 Food safety standards amendment regulations, 2011

7.5.3.3 Food Safety and Standards Act, 2006

7.5.4 AUSTRALIA

7.5.4.1 Food Standards in Australia and New Zealand

7.5.5 NEW ZEALAND

7.5.5.1 GMOs labeling regulation in Asia Pacific

TABLE 27 GMOS LABELING IN ASIA PACIFIC COUNTRIES

7.5.6 INDONESIA

7.5.6.1 General law for food safety

7.5.7 REGULATIONS ON PESTICIDES

7.5.8 REGULATIONS ON MYCOTOXINS IN FOOD

7.5.9 CHEMICAL CONTAMINANTS

7.5.10 GENETICALLY ENGINEERED FOODS

7.5.11 ALLERGEN: REGULATIONS ON ALLERGEN LABELING IN FOOD

7.6 REST OF THE WORLD

7.6.1 SOUTH AFRICA

7.6.1.1 International vs. local standards & legislations

7.6.1.2 Private standards in South Africa and the requirements for product testing

7.6.2 BRAZIL

7.6.2.1 Ministry of Agriculture, Livestock, and Food Supply (MAPA)

7.6.2.2 Ministry of Health (MS)

7.6.3 ARGENTINA

8 FOOD SAFETY TESTING MARKET, BY TARGET TESTED (Page No. - 153)

8.1 INTRODUCTION

FIGURE 45 FOOD SAFETY TESTING MARKET SIZE, BY TARGET TESTED, 2022 VS. 2027 (USD MILLION)

TABLE 28 FOOD SAFETY TESTING MARKET SIZE, BY TARGET TESTED, 2017–2021 (USD MILLION)

TABLE 29 FOOD SAFETY TESTING MARKET SIZE, BY TARGET TESTED, 2022–2027 (USD MILLION)

8.2 PATHOGENS

FIGURE 46 NUMBER OF LABORATORY-DIAGNOSED BACTERIAL AND PARASITIC INFECTIONS, HOSPITALIZATIONS, AND DEATHS IN THE US, 2017–2019

TABLE 30 US: INCIDENCE OF BACTERIAL AND PARASITIC INFECTIONS IN 2020

FIGURE 47 US: MULTISTATE FOODBORNE DISEASE OUTBREAKS, 1998–2018

TABLE 31 PATHOGENS: FOOD SAFETY TESTING MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 32 PATHOGENS: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 33 PATHOGENS: MARKET SIZE, BY FOOD TESTED, 2017–2021 (USD MILLION)

TABLE 34 PATHOGENS: FOOD SAFETY TESTING MARKET SIZE, BY FOOD TESTED, 2022–2027 (USD MILLION)

FIGURE 48 FOOD SAFETY TESTING FOR PATHOGENS, BY FOOD TESTED, 2022–2027 (USD MILLION)

TABLE 35 PATHOGENS: FOOD SAFETY TESTING MARKET SIZE, BY TECHNOLOGY, 2017–2021 (USD MILLION)

TABLE 36 PATHOGENS: MARKET SIZE, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 37 PATHOGENS: MARKET SIZE, BY RAPID TECHNOLOGY, 2017–2021 (USD MILLION)

TABLE 38 PATHOGENS: MARKET SIZE, BY RAPID TECHNOLOGY, 2022–2027 (USD MILLION)

FIGURE 49 SALMONELLA TO LEAD FOOD SAFETY TESTING MARKET, 2022 VS. 2027

TABLE 39 PATHOGENS: FOOD SAFETY TESTING MARKET SIZE, BY SUBSEGMENT, 2017–2021 (USD MILLION)

TABLE 40 PATHOGENS: MARKET SIZE, BY SUBSEGMENT, 2022–2027 (USD MILLION)

8.2.1 E. COLI

8.2.1.1 Food safety testing and supervising hygiene standards can lower events of E. coli food poisoning

FIGURE 50 NUMBER OF LABORATORY-DIAGNOSED INFECTIONS, BY PATHOGEN, MONTH, AND YEAR, 2017–2020

FIGURE 51 TRANSMISSION CYCLE OF ETEC (ENTEROTOXIGENIC E. COLI)

TABLE 41 E. COLI: FOOD SAFETY TESTING MARKET SIZE, BY FOOD TESTED, 2017–2021 (USD MILLION)

TABLE 42 E. COLI: MARKET SIZE, BY FOOD TESTED, 2022–2027 (USD MILLION)

8.2.2 SALMONELLA

8.2.2.1 Major food recalls because of Salmonella contamination

FIGURE 52 US: NUMBER OF LABORATORY-DIAGNOSED INFECTIONS, BY SALMONELLA, MONTH, AND YEAR, 2017–2020

TABLE 43 SALMONELLA: FOOD SAFETY TESTING MARKET SIZE, BY FOOD TESTED, 2017–2021 (USD MILLION)

TABLE 44 SALMONELLA: MARKET SIZE, BY FOOD TESTED, 2022–2027 (USD MILLION)

8.2.3 CAMPYLOBACTER

8.2.3.1 Most common cause of bacterial foodborne illness in North America

FIGURE 53 US: NUMBER OF LABORATORY-DIAGNOSED INFECTIONS, BY CAMPYLOBACTER, MONTH, AND YEAR, 2017–2020

TABLE 45 CAMPYLOBACTER: FOOD SAFETY TESTING MARKET SIZE, BY FOOD TESTED, 2017–2021 (USD MILLION)

TABLE 46 CAMPYLOBACTER: MARKET SIZE, BY FOOD TESTED, 2022–2027 (USD MILLION)

8.2.4 LISTERIA

8.2.4.1 Found in moist environments, soil, water, decaying vegetation, and animals

FIGURE 54 US: MOST COMMON CAUSES FOR FOOD RECALLS IN 2019

TABLE 47 LISTERIA: FOOD SAFETY TESTING MARKET SIZE, BY FOOD TESTED, 2017–2021 (USD MILLION)

TABLE 48 LISTERIA: MARKET SIZE, BY FOOD TESTED, 2022–2027 (USD MILLION)

FIGURE 55 US: NUMBER OF LABORATORY-DIAGNOSED INFECTIONS, BY LISTERIA, MONTH, AND YEAR, 2017–2020

8.2.5 OTHER PATHOGENS

TABLE 49 OTHER PATHOGENS: FOOD SAFETY TESTING MARKET SIZE, BY FOOD TESTED, 2017–2021 (USD MILLION)

TABLE 50 OTHER PATHOGENS: MARKET SIZE, BY FOOD TESTED, 2022–2027 (USD MILLION)

8.3 PESTICIDES

8.3.1 TECHNOLOGICAL ADVANCEMENT IN FOOD SAFETY TESTING

FIGURE 56 US: PESTICIDE DETECTION IN FOOD, 1994–2019

TABLE 51 PESTICIDES: FOOD SAFETY TESTING MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 52 PESTICIDES: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 53 PESTICIDES: MARKET SIZE, BY FOOD TESTED, 2017–2021 (USD MILLION)

TABLE 54 PESTICIDES: MARKET SIZE, BY FOOD TESTED, 2022–2027 (USD MILLION)

TABLE 55 PESTICIDES: MARKET SIZE, BY TECHNOLOGY, 2017–2021 (USD MILLION)

TABLE 56 PESTICIDES: MARKET SIZE, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 57 PESTICIDES: MARKET SIZE, BY RAPID TECHNOLOGY, 2017–2021 (USD MILLION)

TABLE 58 PESTICIDES: FOOD SAFETY TESTING MARKET SIZE, BY RAPID TECHNOLOGY, 2022–2027 (USD MILLION)

8.4 GMOS

8.4.1 HUGE ECONOMIC AND ENVIRONMENTAL BENEFITS

FIGURE 57 INCREASING AREA FOR GM CROP PRODUCTION, 2001–2018 (MILLION HECTARES)

8.4.1.1 GM varieties, by crop

FIGURE 58 GLOBAL ADOPTION OF GM CROPS, 2019

8.4.1.2 GM varieties, by trait

TABLE 59 GMOS: FOOD SAFETY TESTING MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 60 GMOS: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 61 GMOS: MARKET SIZE, BY FOOD TESTED, 2017–2021 (USD MILLION)

TABLE 62 GMOS: MARKET SIZE, BY FOOD TESTED, 2022–2027 (USD MILLION)

TABLE 63 GMOS: MARKET SIZE, BY TECHNOLOGY, 2017–2021 (USD MILLION)

TABLE 64 GMOS: MARKET SIZE, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 65 GMOS: MARKET SIZE, BY RAPID TECHNOLOGY, 2017–2021 (USD MILLION)

TABLE 66 GMOS: MARKET SIZE, BY RAPID TECHNOLOGY, 2022–2027 (USD MILLION)

8.5 MYCOTOXINS

8.5.1 DISTRESS AND ADVERSE HEALTH EFFECTS UPON CONSUMPTION

TABLE 67 FDA ACTION LEVELS FOR AFLATOXINS

TABLE 68 AVERAGE CONCENTRATIONS FOR OCHRATOXIN A IN DIFFERENT FOOD PRODUCTS

TABLE 69 MYCOTOXINS: FOOD SAFETY TESTING MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 70 MYCOTOXINS: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 71 MYCOTOXINS: MARKET SIZE, BY FOOD TESTED, 2017–2021 (USD MILLION)

TABLE 72 MYCOTOXINS: MARKET SIZE, BY FOOD TESTED, 2022–2027 (USD MILLION)

TABLE 73 MYCOTOXINS: MARKET SIZE, BY TECHNOLOGY, 2017–2021 (USD MILLION)

TABLE 74 MYCOTOXINS: MARKET SIZE, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 75 MYCOTOXINS: MARKET SIZE, BY RAPID TECHNOLOGY, |2017–2021 (USD MILLION)

TABLE 76 MYCOTOXINS: FOOD SAFETY TESTING MARKET SIZE, BY RAPID TECHNOLOGY, 2022–2027 (USD MILLION)

8.6 ALLERGENS

8.6.1 STRICT LABELING GUIDELINES FOR ALLERGEN-INDUCED PRODUCTS

TABLE 77 ALLERGENS: FOOD SAFETY TESTING MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 78 ALLERGENS: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 79 ALLERGENS: MARKET SIZE, BY FOOD TESTED, 2017–2021 (USD MILLION)

TABLE 80 ALLERGENS: MARKET SIZE, BY FOOD TESTED, 2022–2027 (USD MILLION)

TABLE 81 ALLERGENS: MARKET SIZE, BY TECHNOLOGY, 2017–2021 (USD MILLION)

TABLE 82 ALLERGENS: MARKET SIZE, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 83 ALLERGENS: MARKET SIZE, BY RAPID TECHNOLOGY, 2017–2021 (USD MILLION)

TABLE 84 ALLERGENS: FOOD SAFETY TESTING MARKET SIZE, BY RAPID TECHNOLOGY, 2022–2027 (USD MILLION)

8.7 HEAVY METALS

8.7.1 CONTAMINATION OF FOOD CHAIN AND HARM TO PUBLIC HEALTH

TABLE 85 SPECIFIC RELEASE LIMITS (SRL) FOR HEAVY METALS AS CONTAMINANTS & IMPURITIES

TABLE 86 HEAVY METALS: FOOD SAFETY TESTING MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 87 HEAVY METALS: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 88 HEAVY METALS: MARKET SIZE, BY FOOD TESTED, 2017–2021 (USD MILLION)

TABLE 89 HEAVY METALS: MARKET SIZE, BY FOOD TESTED, 2022–2027 (USD MILLION)

TABLE 90 HEAVY METALS: MARKET SIZE, BY TECHNOLOGY, 2017–2021 (USD MILLION)

TABLE 91 HEAVY METALS: MARKET SIZE, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 92 HEAVY METALS: MARKET SIZE, BY RAPID TECHNOLOGY, 2017–2021 (USD MILLION)

TABLE 93 HEAVY METALS: FOOD SAFETY TESTING MARKET SIZE, BY RAPID TECHNOLOGY, 2022–2027 (USD MILLION)

8.8 OTHERS

TABLE 94 OTHERS: FOOD SAFETY TESTING MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 95 OTHERS: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 96 OTHERS: MARKET SIZE, BY FOOD TESTED, 2017–2021 (USD MILLION)

TABLE 97 OTHERS: MARKET SIZE, BY FOOD TESTED, 2022–2027 (USD MILLION)

TABLE 98 OTHERS: MARKET SIZE, BY TECHNOLOGY, 2017–2021 (USD MILLION)

TABLE 99 OTHERS: MARKET SIZE, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 100 OTHERS: MARKET SIZE, BY RAPID TECHNOLOGY, 2017–2021 (USD MILLION)

TABLE 101 OTHERS: MARKET SIZE, BY RAPID TECHNOLOGY, 2022–2027 (USD MILLION)

9 FOOD SAFETY TESTING MARKET, BY FOOD TESTED (Page No. - 195)

9.1 INTRODUCTION

TABLE 102 FOOD SAFETY TESTING MARKET: FOODBORNE PATHOGENS, BY FOOD SOURCE

FIGURE 59 US: FOODS THAT CAUSED OUTBREAK-ASSOCIATED ILLNESSES, 2009–2018

FIGURE 60 EU: NUMBER OF OUTBREAKS AND HUMAN CASES, BY FOOD VEHICLE, 2019

TABLE 103 EU: OCCURRENCE OF CAMPYLOBACTER IN MAJOR FOOD CATEGORIES

TABLE 104 FOOD RECALLS IN US, 2021–2022

FIGURE 61 US: FOOD RECALLS, BY CONTAMINANT CATEGORY, 2021

FIGURE 62 FOOD SAFETY TESTING MARKET SIZE, BY FOOD TESTED, 2022 VS. 2027

TABLE 105 FOOD SAFETY TESTING MARKET SIZE, BY FOOD TESTED, 2017–2021 (USD MILLION)

TABLE 106 FOOD SAFETY TESTING MARKET SIZE, BY FOOD TESTED, 2022–2027 (USD MILLION)

9.2 MEAT, POULTRY, AND SEAFOOD

9.2.1 UNSANITARY ABATTOIRS AND IMPROPER ANIMAL HANDLING CAUSE FOODBORNE DISEASES

FIGURE 63 EU: FREQUENCY DISTRIBUTION OF STRONG-EVIDENCE FOODBORNE OUTBREAKS, BY FOOD VEHICLE, 2020

TABLE 107 FOOD SAFETY TESTING MARKET SIZE FOR MEAT, POULTRY, AND SEAFOOD, BY TARGET TESTED, 2017–2021 (USD MILLION)

TABLE 108 MARKET SIZE FOR MEAT, POULTRY, AND SEAFOOD, BY TARGET TESTED, 2022–2027 (USD MILLION)

TABLE 109 MARKET SIZE FOR MEAT, POULTRY, AND SEAFOOD, BY PATHOGEN, 2017–2021 (USD MILLION)

TABLE 110 MARKET SIZE FOR MEAT, POULTRY, AND SEAFOOD, BY PATHOGEN, 2022–2027 (USD MILLION)

9.3 DAIRY PRODUCTS

9.3.1 OUTBREAK OF ILLNESSES DUE TO CONSUMPTION OF UNPASTEURIZED MILK

FIGURE 64 EU: FREQUENCY DISTRIBUTION OF FOODBORNE ILLNESSES RELATED TO DAIRY PRODUCTS, 2020

TABLE 111 FOOD SAFETY TESTING MARKET SIZE FOR DAIRY PRODUCTS, BY TARGET TESTED, 2017–2021 (USD MILLION)

TABLE 112 MARKET SIZE FOR DAIRY PRODUCTS, BY TARGET TESTED, 2022–2027 (USD MILLION)

TABLE 113 MARKET SIZE FOR DAIRY PRODUCTS, BY PATHOGEN, 2017–2021 (USD MILLION)

TABLE 114 MARKET SIZE FOR DAIRY PRODUCTS, BY PATHOGEN, 2022–2027 (USD MILLION)

9.4 PROCESSED FOOD

9.4.1 RISING NUMBER OF RETAIL MARKETS FOR CONTAMINATED RTE FOOD PRODUCTS POSES A CHALLENGE

TABLE 115 FOOD SAFETY TESTING MARKET SIZE FOR PROCESSED FOODS, BY TARGET TESTED, 2017–2021 (USD MILLION)

TABLE 116 MARKET SIZE FOR PROCESSED FOODS, BY TARGET TESTED, 2022–2027 (USD MILLION)

TABLE 117 MARKET SIZE FOR PROCESSED FOODS, BY PATHOGEN, 2017–2021 (USD MILLION)

TABLE 118 FOOD SAFETY TESTING MARKET SIZE FOR PROCESSED FOODS, BY PATHOGEN, 2022–2027 (USD MILLION)

9.5 FRUITS & VEGETABLES

9.5.1 PESTICIDE RESIDUES TO BE A CHALLENGE

TABLE 119 FOOD SAFETY TESTING MARKET SIZE FOR FRUITS AND VEGETABLES, BY TARGET TESTED, 2017–2021 (USD MILLION)

TABLE 120 MARKET SIZE FOR FRUITS AND VEGETABLES, BY TARGET TESTED, 2022–2027 (USD MILLION)

TABLE 121 MARKET SIZE FOR FRUITS & VEGETABLES, BY PATHOGEN, 2017–2021 (USD MILLION)

TABLE 122 MARKET SIZE FOR FRUITS & VEGETABLES, BY PATHOGEN, 2022–2027 (USD MILLION)

9.6 CEREALS & GRAINS

9.6.1 CONTAMINATION WITH TOXINS

TABLE 123 FOOD SAFETY TESTING MARKET SIZE FOR CEREALS AND GRAINS, BY TARGET TESTED, 2017–2021 (USD MILLION)

TABLE 124 MARKET SIZE FOR CEREALS AND GRAINS, BY TARGET TESTED, 2022–2027 (USD MILLION)

TABLE 125 MARKET SIZE FOR CEREALS AND GRAINS, BY PATHOGEN, 2017–2021 (USD MILLION)

TABLE 126 MARKET SIZE FOR CEREALS AND GRAINS, BY PATHOGEN, 2022–2027 (USD MILLION)

9.7 OTHERS

TABLE 127 FOOD SAFETY TESTING MARKET SIZE FOR OTHERS, BY TARGET TESTED, 2017–2021 (USD MILLION)

TABLE 128 MARKET SIZE FOR OTHERS, BY TARGET TESTED, 2022–2027 (USD MILLION)

TABLE 129 MARKET SIZE FOR OTHERS, BY PATHOGEN, 2017–2021 (USD MILLION)

TABLE 130 MARKET SIZE FOR OTHERS, BY PATHOGEN, 2022–2027 (USD MILLION)

10 FOOD SAFETY TESTING MARKET, BY TECHNOLOGY (Page No. - 216)

10.1 INTRODUCTION

FIGURE 65 FOOD SAFETY TESTING MARKET SIZE, BY TECHNOLOGY, 2022 VS. 2027 (USD MILLION)

TABLE 131 MARKET SIZE, BY TECHNOLOGY, 2017–2021 (USD MILLION)

TABLE 132 MARKET SIZE, BY TECHNOLOGY, 2022–2027 (USD MILLION)

10.2 TRADITIONAL

10.2.1 TO BE INCORPORATED INTO READY-TO-EAT FOODS

TABLE 133 TRADITIONAL FOOD SAFETY TESTING TECHNOLOGY MARKET SIZE, BY TARGET TESTED, 2017–2021 (USD MILLION)

TABLE 134 TRADITIONAL FOOD SAFETY TESTING TECHNOLOGY MARKET SIZE, BY TARGET TESTED, 2022–2027 (USD MILLION)

10.3 RAPID

10.3.1 MITIGATION OF HUMAN ERRORS VIA RAPID FOOD TESTING

TABLE 135 RAPID FOOD SAFETY TESTING TECHNOLOGY MARKET SIZE, BY TARGET TESTED, 2017–2021 (USD MILLION)

TABLE 136 RAPID FOOD SAFETY TESTING TECHNOLOGY MARKET SIZE, BY TARGET TESTED, 2022–2027 (USD MILLION)

TABLE 137 RAPID FOOD SAFETY TESTING TECHNOLOGY MARKET SIZE, BY SUBSEGMENT, 2017–2021 (USD MILLION)

TABLE 138 RAPID FOOD SAFETY TESTING TECHNOLOGY MARKET SIZE, BY SUBSEGMENT, 2022–2027 (USD MILLION)

10.3.2 CONVENIENCE-BASED

10.3.2.1 Helps in identifying microorganisms based on their biochemical responses

TABLE 139 CONVENIENCE-BASED: FOOD SAFETY TESTING MARKET SIZE, BY TARGET TESTED, 2017–2021 (USD MILLION)

TABLE 140 CONVENIENCE-BASED: FOOD SAFETY TESTING MARKET SIZE, BY TARGET TESTED, 2022–2027 (USD MILLION)

10.3.3 POLYMERASE CHAIN REACTION (PCR)

10.3.3.1 Flexibility of PCR systems allows for several pathogens to be assayed in single run

TABLE 141 PCR BASED: FOOD SAFETY TESTING MARKET SIZE, BY TARGET TESTED, 2017–2021 (USD MILLION)

TABLE 142 PCR BASED: FOOD SAFETY TESTING MARKET SIZE, BY TARGET TESTED, 2022–2027 (USD MILLION)

10.3.4 IMMUNOASSAY

10.3.4.1 ELISA–Powerful method for detecting and quantifying specific proteins in complex mixture

TABLE 143 IMMUNOASSAY: FOOD SAFETY TESTING MARKET SIZE, BY TARGET TESTED, 2017–2021 (USD MILLION)

TABLE 144 IMMUNOASSAY: MARKET SIZE, BY TARGET TESTED, 2022–2027 (USD MILLION)

10.3.5 CHROMATOGRAPHY & SPECTROMETRY

10.3.5.1 Inductively Coupled Plasma (ICP)– Major advancement in mass spectrometry

TABLE 145 CHROMATOGRAPHY & SPECTROMETRY: FOOD SAFETY TESTING MARKET SIZE, BY TARGET TESTED, 2017–2021 (USD MILLION)

TABLE 146 CHROMATOGRAPHY & SPECTROMETRY: MARKET SIZE, BY TARGET TESTED, 2022–2027 (USD MILLION)

11 FOOD SAFETY TESTING MARKET, BY REGION (Page No. - 227)

11.1 INTRODUCTION

TABLE 147 FOOD SAFETY TESTING MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 148 FOOD SAFETY TESTING MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

FIGURE 66 CHINA TO GROW AT HIGHEST RATE IN FOOD SAFETY TESTING MARKET, 2022–2027

11.2 NORTH AMERICA

TABLE 149 NORTH AMERICA: FOOD SAFETY TESTING MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 150 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027(USD MILLION)

TABLE 151 NORTH AMERICA: MARKET SIZE, BY TARGET TESTED, 2017–2021 (USD MILLION)

TABLE 152 NORTH AMERICA: MARKET SIZE, BY TARGET TESTED, 2022–2027 (USD MILLION)

TABLE 153 NORTH AMERICA: MARKET SIZE FOR PATHOGENS, BY COUNTRY 2017–2021 (USD MILLION)

TABLE 154 NORTH AMERICA: MARKET SIZE FOR PATHOGENS, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 155 NORTH AMERICA: MARKET SIZE FOR GMOS, BY COUNTRY 2017–2021 (USD MILLION)

TABLE 156 NORTH AMERICA: MARKET SIZE FOR GMOS, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 157 NORTH AMERICA: MARKET SIZE FOR PESTICIDES, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 158 NORTH AMERICA: MARKET SIZE FOR PESTICIDES, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 159 NORTH AMERICA: MARKET SIZE FOR MYCOTOXINS, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 160 NORTH AMERICA: MARKET SIZE FOR MYCOTOXINS, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 161 NORTH AMERICA: MARKET SIZE FOR ALLERGENS, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 162 NORTH AMERICA: MARKET SIZE FOR ALLERGENS, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 163 NORTH AMERICA: MARKET SIZE FOR HEAVY METALS, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 164 NORTH AMERICA: MARKET SIZE FOR HEAVY METALS, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 165 NORTH AMERICA: MARKET SIZE FOR OTHER CONTAMINANTS, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 166 NORTH AMERICA: FOOD SAFETY TESTING MARKET SIZE FOR OTHER CONTAMINANTS, BY COUNTRY/REGION, 2022–2027 (USD MILLION)

11.2.1 US

11.2.1.1 Food recall by USDA owing to possibility of contamination has gained attention

FIGURE 67 US: PATHOGEN INCIDENCE PER 100,000 POPULATION, INFECTION BY YEAR, 1996–2020

FIGURE 68 NUMBER OF PATHOGEN/TOXIN VIOLATIONS IN US FOOD IMPORTS, 2002 TO 2019

TABLE 167 ESTIMATED EFFECTS OF FOODBORNE AGENTS IN THE US (2016)

TABLE 168 US: FOOD SAFETY TESTING MARKET SIZE, BY TARGET TESTED, 2017–2021 (USD MILLION)

TABLE 169 US: FOOD SAFETY TESTING MARKET SIZE, BY TARGET TESTED, 2022–2027(USD MILLION)

11.2.2 CANADA

11.2.2.1 Regulates food safety with high priority while exporting goods

TABLE 170 CANADA: FOOD SAFETY TESTING MARKET SIZE, BY TARGET TESTED, 2017–2021 (USD MILLION)

TABLE 171 CANADA: FOOD SAFETY TESTING MARKET SIZE, BY TARGET TESTED, 2022–2027(USD MILLION)

11.2.3 MEXICO

11.2.3.1 Increasing incidences of foodborne diseases

TABLE 172 MEXICO: FOOD SAFETY TESTING MARKET SIZE, BY TARGET TESTED, 2017–2021 (USD MILLION)

TABLE 173 MEXICO: FOOD SAFETY TESTING MARKET SIZE, BY TARGET TESTED, 2022–2027(USD MILLION)

11.3 EUROPE

FIGURE 69 EUROPE: FOOD SAFETY TESTING MARKET SNAPSHOT, 2021

TABLE 174 EUROPE: FOOD SAFETY TESTING MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 175 EUROPE: MARKET SIZE, BY COUNTRY, 2022–2027(USD MILLION)

TABLE 176 EUROPE: MARKET SIZE, BY TARGET TESTED, 2017–2021 (USD MILLION)

TABLE 177 EUROPE: MARKET SIZE, BY TARGET TESTED, 2022–2027 (USD MILLION)

TABLE 178 EUROPE: MARKET SIZE FOR PATHOGENS, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 179 EUROPE: MARKET SIZE FOR PATHOGENS, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 180 EUROPE: MARKET SIZE FOR GMOS, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 181 EUROPE: MARKET SIZE FOR GMOS, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 182 EUROPE: MARKET SIZE FOR PESTICIDES, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 183 EUROPE: MARKET SIZE FOR PESTICIDES, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 184 EUROPE: MARKET SIZE FOR MYCOTOXINS, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 185 EUROPE: MARKET SIZE FOR MYCOTOXINS, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 186 EUROPE: MARKET SIZE FOR ALLERGENS, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 187 EUROPE: MARKET SIZE FOR ALLERGENS, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 188 EUROPE: MARKET SIZE FOR HEAVY METALS, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 189 EUROPE: MARKET SIZE FOR HEAVY METALS, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 190 EUROPE: FOOD SAFETY TESTING MARKET SIZE FOR OTHER CONTAMINANTS, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 191 EUROPE: FOOD SAFETY TESTING MARKET SIZE FOR OTHER CONTAMINANTS, BY COUNTRY, 2022–2027 (USD MILLION)

11.3.1 GERMANY

11.3.1.1 Highly stringent regulation on following EU norms on food safety

TABLE 192 GERMANY: FOOD SAFETY TESTING MARKET SIZE, BY TARGET TESTED, 2017–2021 (USD MILLION)

TABLE 193 GERMANY: FOOD SAFETY TESTING MARKET SIZE, BY TARGET TESTED, 2022–2027 (USD MILLION)

11.3.2 UK

11.3.2.1 Growing number of food poisoning incidences

TABLE 194 UK: FOOD SAFETY TESTING MARKET SIZE, BY TARGET TESTED, 2017–2021 (USD MILLION)

TABLE 195 UK: FOOD SAFETY TESTING MARKET SIZE, BY TARGET TESTED, 2022–2027 (USD MILLION)

11.3.3 FRANCE

11.3.3.1 Large number of foodborne outbreaks promote food safety testing

TABLE 196 FRANCE: FOOD SAFETY TESTING MARKET SIZE, BY TARGET TESTED, 2017–2021 (USD MILLION)

TABLE 197 FRANCE: FOOD SAFETY TESTING MARKET SIZE, BY TARGET TESTED, 2022–2027 (USD MILLION)

11.3.4 ITALY

11.3.4.1 Stringent food safety regulations implemented by EU

TABLE 198 ITALY: FOOD SAFETY TESTING MARKET SIZE, BY TARGET TESTED, 2017–2021 (USD MILLION)

TABLE 199 ITALY: FOOD SAFETY TESTING MARKET SIZE, BY TARGET TESTED, 2022–2027 (USD MILLION)

11.3.5 POLAND

11.3.5.1 Increasing trade resulting in growing requirement for food safety testing

TABLE 200 POLAND: FOOD SAFETY TESTING MARKET SIZE, BY TARGET TESTED, 2017–2021 (USD MILLION)

TABLE 201 POLAND: FOOD SAFETY TESTING MARKET SIZE, BY TARGET TESTED, 2022–2027 (USD MILLION)

11.3.6 REST OF EUROPE

TABLE 202 REST OF EUROPE: FOOD SAFETY TESTING MARKET SIZE, BY TARGET TESTED, 2017–2021 (USD MILLION)

TABLE 203 REST OF EUROPE: FOOD SAFETY TESTING MARKET SIZE, BY TARGET TESTED, 2022–2027 (USD MILLION)

11.4 ASIA PACIFIC

FIGURE 70 ASIA PACIFIC: FOOD SAFETY TESTING MARKET SNAPSHOT

TABLE 204 ASIA PACIFIC: FOOD SAFETY TESTING MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 205 ASIA PACIFIC: FOOD SAFETY TESTING MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 206 ASIA PACIFIC: FOOD SAFETY TESTING MARKET SIZE, BY TARGET TESTED, 2017–2021 (USD MILLION)

TABLE 207 ASIA PACIFIC: FOOD SAFETY TESTING MARKET SIZE, BY TARGET TESTED, 2022–2027 (USD MILLION)

TABLE 208 ASIA PACIFIC: FOOD SAFETY TESTING MARKET SIZE FOR PATHOGENS, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 209 ASIA PACIFIC: FOOD SAFETY TESTING MARKET SIZE FOR PATHOGENS, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 210 ASIA PACIFIC: FOOD SAFETY TESTING MARKET SIZE FOR GMOS, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 211 ASIA PACIFIC: FOOD SAFETY TESTING MARKET SIZE FOR GMOS, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 212 ASIA PACIFIC: FOOD SAFETY TESTING MARKET SIZE FOR PESTICIDES, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 213 ASIA PACIFIC: FOOD SAFETY TESTING MARKET SIZE FOR PESTICIDES, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 214 ASIA PACIFIC: FOOD SAFETY TESTING MARKET SIZE FOR MYCOTOXINS, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 215 ASIA PACIFIC: FOOD SAFETY TESTING MARKET SIZE FOR MYCOTOXINS, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 216 ASIA PACIFIC: FOOD SAFETY TESTING MARKET SIZE FOR ALLERGENS, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 217 ASIA PACIFIC: FOOD SAFETY TESTING MARKET SIZE FOR ALLERGENS, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 218 ASIA PACIFIC: FOOD SAFETY TESTING MARKET SIZE FOR HEAVY METALS, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 219 ASIA PACIFIC: FOOD SAFETY TESTING MARKET SIZE FOR HEAVY METALS, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 220 ASIA PACIFIC: FOOD SAFETY TESTING MARKET SIZE FOR OTHER CONTAMINANTS, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 221 ASIA PACIFIC: FOOD SAFETY TESTING MARKET SIZE FOR OTHER CONTAMINANTS, BY COUNTRY, 2022–2027 (USD MILLION)

11.4.1 JAPAN

11.4.1.1 Standard food testing processes to meet domestic and international food safety standards

TABLE 222 JAPAN: FOOD SAFETY TESTING MARKET SIZE, BY TARGET TESTED, 2017–2021 (USD MILLION)

TABLE 223 JAPAN: FOOD SAFETY TESTING MARKET SIZE, BY TARGET TESTED, 2022–2027 (USD MILLION)

11.4.2 CHINA

11.4.2.1 Increase in number of food safety regulations

TABLE 224 CHINA: FOOD SAFETY TESTING MARKET SIZE, BY TARGET TESTED, 2017–2021 (USD MILLION)

TABLE 225 CHINA: FOOD SAFETY TESTING MARKET SIZE, BY TARGET TESTED, 2022–2027 (USD MILLION)

11.4.3 INDIA

11.4.3.1 Food laboratories implementing new technologies and modern analytical instruments

TABLE 226 INDIA: FOOD SAFETY TESTING MARKET SIZE, BY TARGET TESTED, 2017–2021 (USD MILLION)

TABLE 227 INDIA: FOOD SAFETY TESTING MARKET SIZE, BY TARGET TESTED, 2022–2027 (USD MILLION)

11.4.4 AUSTRALIA & NEW ZEALAND

11.4.4.1 Export of various agricultural products requires stringent food safety programs

TABLE 228 AUSTRALIA & NEW ZEALAND: FOOD SAFETY TESTING MARKET SIZE, BY TARGET TESTED, 2017–2021 (USD MILLION)

TABLE 229 AUSTRALIA & NEW ZEALAND: FOOD SAFETY TESTING MARKET SIZE, BY TARGET TESTED, 2022–2027 (USD MILLION)

11.4.5 REST OF ASIA PACIFIC

TABLE 230 REST OF ASIA PACIFIC: FOOD SAFETY TESTING MARKET SIZE, BY TARGET TESTED, 2017–2021 (USD MILLION)

TABLE 231 REST OF ASIA PACIFIC: FOOD SAFETY TESTING MARKET SIZE, BY TARGET TESTED, 2022–2027 (USD MILLION)

11.5 REST OF THE WORLD (ROW)

TABLE 232 ROW: FOOD SAFETY TESTING MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 233 ROW: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 234 ROW: FOOD SAFETY TESTING MARKET SIZE, BY TARGET TESTED, 2017–2021 (USD MILLION)

TABLE 235 ROW: FOOD SAFETY TESTING MARKET SIZE, BY TARGET TESTED, 2022–2027 (USD MILLION)

TABLE 236 ROW: MARKET SIZE FOR PATHOGENS, BY REGION, 2017–2021 (USD MILLION)

TABLE 237 ROW: MARKET SIZE FOR PATHOGENS, BY REGION, 2022–2027 (USD MILLION)

TABLE 238 ROW: MARKET SIZE FOR GMOS, BY REGION, 2017–2021 (USD MILLION)

TABLE 239 ROW: MARKET SIZE FOR GMOS, BY REGION, 2022–2027 (USD MILLION)

TABLE 240 ROW: MARKET SIZE FOR PESTICIDES, BY REGION, 2017–2021 (USD MILLION)

TABLE 241 ROW: MARKET SIZE FOR PESTICIDES, BY REGION, 2022–2027 (USD MILLION)

TABLE 242 ROW: MARKET SIZE FOR MYCOTOXINS, BY REGION, 2017–2021 (USD MILLION)

TABLE 243 ROW: MARKET SIZE FOR MYCOTOXINS, BY REGION, 2022–2027 (USD MILLION)

TABLE 244 ROW: MARKET SIZE FOR ALLERGENS, BY REGION, 2017–2021 (USD MILLION)

TABLE 245 ROW: FOOD SAFETY TESTING MARKET SIZE FOR ALLERGENS, BY REGION, 2022–2027 (USD MILLION)

TABLE 246 ROW: FOOD SAFETY TESTING MARKET SIZE FOR HEAVY METALS, BY REGION, 2017–2021 (USD MILLION)

TABLE 247 ROW: FOOD SAFETY TESTING MARKET SIZE FOR HEAVY METALS, BY REGION, 2022–2027 (USD MILLION)

TABLE 248 ROW: FOOD SAFETY TESTING MARKET SIZE FOR OTHERS, BY REGION, 2017–2021 (USD MILLION)

TABLE 249 ROW: FOOD SAFETY TESTING MARKET SIZE FOR OTHERS, BY REGION, 2022–2027 (USD MILLION)

11.5.1 SOUTH AMERICA

11.5.1.1 Technology upgrade in food safety testing services

TABLE 250 SOUTH AMERICA: FOOD SAFETY TESTING MARKET SIZE, BY TARGET TESTED, 2017–2021 (USD MILLION)

TABLE 251 SOUTH AMERICA: FOOD SAFETY TESTING MARKET SIZE, BY TARGET TESTED, 2022–2027 (USD MILLION)

11.5.2 AFRICA

11.5.2.1 Emerging industrial platform, foodborne outbreaks, and growth in demand for food safety to follow international standards

TABLE 252 AFRICA: FOOD SAFETY TESTING MARKET SIZE, BY TARGET TESTED, 2017–2021 (USD MILLION)

TABLE 253 AFRICA: MARKET SIZE, BY TARGET TESTED, 2022–2027 (USD MILLION)

11.5.3 MIDDLE EAST

11.5.3.1 Driven by food imports from other countries

TABLE 254 MIDDLE EAST: FOOD SAFETY TESTING MARKET SIZE, BY TARGET TESTED, 2017–2021 (USD MILLION)

TABLE 255 MIDDLE EAST: MARKET SIZE, BY TARGET TESTED, 2022–2027 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 283)

12.1 OVERVIEW

12.2 KEY PLAYERS’ STRATEGIES

TABLE 256 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

12.3 MARKET SHARE ANALYSIS, 2021

TABLE 257 FOOD SAFETY TESTING: MARKET SHARE ANALYSIS

12.4 SEGMENT REVENUE ANALYSIS OF KEY PLAYERS, 2017–2021

FIGURE 71 SEGMENTAL REVENUE ANALYSIS OF KEY MARKET PLAYERS, 2017–2021 (USD BILLION)

12.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

12.5.1 STARS

12.5.2 EMERGING LEADERS

12.5.3 PERVASIVE PLAYERS

12.5.4 PARTICIPANTS

FIGURE 72 FOOD SAFETY TESTING MARKET: COMPANY EVALUATION QUADRANT OF KEY PLAYERS, 2021

12.6 SERVICE FOOTPRINT

TABLE 258 COMPANY, BY TARGET TESTED FOOTPRINT

TABLE 259 COMPANY, BY TECHNOLOGY FOOTPRINT

TABLE 260 COMPANY, BY REGION FOOTPRINT

TABLE 261 OVERALL FOOTPRINT

12.7 START-UP/SME EVALUATION QUADRANT (OTHER PLAYERS)

12.7.1 PROGRESSIVE COMPANIES

12.7.2 STARTING BLOCKS

12.7.3 RESPONSIVE COMPANIES

12.7.4 DYNAMIC COMPANIES

FIGURE 73 FOOD SAFETY TESTING MARKET: COMPANY EVALUATION QUADRANT OF START-UPS/SMES, 2021

12.7.5 COMPETITIVE BENCHMARKING

TABLE 262 FOOD SAFETY TESTING MARKET: DETAILED LIST OF KEY START-UPS/SMES

TABLE 263 FOOD SAFETY TESTING MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

12.8 COMPETITIVE SCENARIO AND TRENDS

12.8.1 SERVICE LAUNCHES

TABLE 264 FOOD SAFETY TESTING MARKET: SERVICE LAUNCHES, MARCH 2019–MARCH 2022

12.8.2 DEALS

TABLE 265 FOOD SAFETY TESTING MARKET: DEALS, JANUARY 2018–AUGUST 2022

12.8.3 OTHERS

TABLE 266 FOOD SAFETY TESTING MARKET: OTHERS, MARCH 2018–JUNE 2022

13 COMPANY PROFILES (Page No. - 309)

13.1 KEY PLAYERS

(Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)*

13.1.1 EUROFINS SCIENTIFIC

TABLE 267 EUROFINS SCIENTIFIC: COMPANY OVERVIEW

FIGURE 74 EUROFINS SCIENTIFIC: COMPANY SNAPSHOT

TABLE 268 EUROFINS SCIENTIFIC: SERVICES OFFERED

TABLE 269 EUROFINS SCIENTIFIC: SERVICE LAUNCHES

TABLE 270 EUROFINS SCIENTIFIC: DEALS

13.1.2 INTERTEK GROUP PLC

TABLE 271 INTERTEK GROUP PLC: COMPANY OVERVIEW

FIGURE 75 INTERTEK GROUP PLC: COMPANY SNAPSHOT

TABLE 272 INTERTEK GROUP PLC: SERVICES OFFERED

TABLE 273 INTERTEK GROUP PLC: DEALS

13.1.3 BUREAU VERITAS

TABLE 274 BUREAU VERITAS: COMPANY OVERVIEW

FIGURE 76 BUREAU VERITAS: COMPANY SNAPSHOT

TABLE 275 BUREAU VERITAS: SERVICES OFFERED

TABLE 276 BUREAU VERITAS: DEALS

TABLE 277 BUREAU VERITAS: OTHERS

13.1.4 ALS LIMITED

TABLE 278 ALS LIMITED: COMPANY OVERVIEW

FIGURE 77 ALS LIMITED: COMPANY SNAPSHOT

TABLE 279 ALS LIMITED: SERVICES OFFERED

TABLE 280 ALS LIMITED: DEALS

13.1.5 SGS SA

TABLE 281 SGS SA: COMPANY OVERVIEW

FIGURE 78 SGS SA: COMPANY SNAPSHOT

TABLE 282 SGS SA: SERVICES OFFERED

TABLE 283 SGS SA: DEALS

TABLE 284 SGS SA: OTHERS

13.1.6 ASUREQUALITY

TABLE 285 ASUREQUALITY: COMPANY OVERVIEW

FIGURE 79 ASUREQUALITY: COMPANY SNAPSHOT

TABLE 286 ASUREQUALITY: SERVICES OFFERED

TABLE 287 ASUREQUALITY: DEALS

13.1.7 TÜV SÜD

TABLE 288 TÜV SÜD: COMPANY OVERVIEW

FIGURE 80 TÜV SÜD: COMPANY SNAPSHOT

TABLE 289 TÜV SÜD: SERVICES OFFERED

13.1.8 TÜV NORD GROUP

TABLE 290 TÜV NORD GROUP: COMPANY OVERVIEW

FIGURE 81 TÜV NORD GROUP: COMPANY SNAPSHOT

TABLE 291 TÜV NORD GROUP: SERVICES OFFERED

TABLE 292 TÜV NORD GROUP: SERVICE LAUNCHES

TABLE 293 TÜV NORD GROUP: OTHERS

13.1.9 MICROBAC LABORATORIES, INC.

TABLE 294 MICROBAC LABORATORIES, INC.: COMPANY OVERVIEW

TABLE 295 MICROBAC LABORATORIES, INC.: SERVICES OFFERED

TABLE 296 MICROBAC LABORATORIES, INC.: OTHERS

13.1.10 ROMER LABS

TABLE 297 ROMER LABS: COMPANY OVERVIEW

TABLE 298 ROMER LABS: SERVICES OFFERED

TABLE 299 ROMER LABS: SERVICE LAUNCHES

TABLE 300 ROMER LABS: OTHERS

13.1.11 SYMBIO LABORATORIES

TABLE 301 SYMBIO LABORATORIES: COMPANY OVERVIEW

TABLE 302 SYMBIO LABORATORIES: SERVICES OFFERED

TABLE 303 SYMBIO LABORATORIES: DEALS

13.1.12 NEOGEN CORPORATION

TABLE 304 NEOGEN CORPORATION: COMPANY OVERVIEW

FIGURE 82 NEOGEN CORPORATION: COMPANY SNAPSHOT

TABLE 305 NEOGEN CORPORATION: SERVICES OFFERED

TABLE 306 NEOGEN CORPORATION: SERVICE LAUNCHES

TABLE 307 NEOGEN CORPORATION: DEALS

13.1.13 MÉRIEUX NUTRISCIENCES CORPORATION

TABLE 308 MÉRIEUX NUTRISCIENCES CORPORATION: COMPANY OVERVIEW

TABLE 309 MÉRIEUX NUTRISCIENCES CORPORATION: SERVICES OFFERED

TABLE 310 MÉRIEUX NUTRISCIENCES CORPORATION: DEALS

TABLE 311 MÉRIEUX NUTRISCIENCES CORPORATION: OTHERS

13.1.14 R J HILL LABORATORIES LIMITED

TABLE 312 R J HILL LABORATORIES LIMITED: COMPANY OVERVIEW

TABLE 313 R J HILL LABORATORIES LIMITED: SERVICES OFFERED

TABLE 314 R J HILL LABORATORIES LIMITED: SERVICE LAUNCHES

TABLE 315 R J HILL LABORATORIES LIMITED: OTHERS

13.1.15 FOODCHAIN ID

TABLE 316 FOODCHAIN ID: COMPANY OVERVIEW

TABLE 317 FOODCHAIN ID: SERVICES OFFERED

TABLE 318 FOODCHAIN ID: DEALS

13.2 START-UPS/SMES/OTHER PLAYERS

13.2.1 IFP INSTITUT FÜR PRODUKTQUALITÄT GMBH

TABLE 319 IFP INSTITUT FÜR PRODUKTQUALITÄT GMBH: COMPANY OVERVIEW

TABLE 320 IFP INSTITUT FÜR PRODUKTQUALITÄT GMBH: SERVICES OFFERED

TABLE 321 IFP INSTITUT FÜR PRODUKTQUALITÄT GMBH: OTHERS

13.2.2 NOVA BIOLOGICALS

TABLE 322 NOVA BIOLOGICALS: COMPANY OVERVIEW

TABLE 323 NOVA BIOLOGICALS: SERVICES OFFERED

TABLE 324 NOVA BIOLOGICALS: OTHERS

13.2.3 CERTIFIED LABORATORIES

TABLE 325 CERTIFIED LABORATORIES: COMPANY OVERVIEW

TABLE 326 CERTIFIED LABORATORIES: SERVICES OFFERED

TABLE 327 CERTIFIED LABORATORIES: DEALS

13.2.4 AGROLAB GMBH

TABLE 328 AGROLAB GMBH: COMPANY OVERVIEW

TABLE 329 AGROLAB GMBH: SERVICES OFFERED

TABLE 330 AGROLAB GMBH: SERVICE LAUNCHES

TABLE 331 AGROLAB GMBH: OTHERS

13.2.5 AGQ LABS USA

TABLE 332 AGQ LABS USA: COMPANY OVERVIEW

TABLE 333 AGQ LABS USA: SERVICES OFFERED

TABLE 334 AGQ LABS USA: DEALS

*Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

13.2.6 CAMPDEN BRI

13.2.7 MITRA SK PRIVATE LIMITED

13.2.8 ELEMENT MATERIALS TECHNOLOGY

13.2.9 DAANE LABS

13.2.10 COTECNA INSPECTION SA

14 ADJACENT AND RELATED MARKETS (Page No. - 371)

14.1 INTRODUCTION

TABLE 335 ADJACENT MARKETS TO THE FOOD SAFETY TESTING MARKET

14.2 LIMITATIONS

14.3 FOOD AUTHENTICITY TESTING MARKET

14.3.1 MARKET DEFINITION

14.3.2 MARKET OVERVIEW

TABLE 336 FOOD AUTHENTICITY TESTING MARKET SIZE, BY FOOD TESTED, 2014–2022 (USD MILLION)

14.4 GM FOOD SAFETY TESTING MARKET

14.4.1 MARKET DEFINITION

14.4.2 MARKET OVERVIEW

TABLE 337 GM FOOD SAFETY TESTING MARKET SIZE, BY FOOD TESTED, 2015–2022 (USD MILLION)

15 APPENDIX (Page No. - 374)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.3.1 SEGMENT ANALYSIS

15.3.1.1 Geographic analysis

15.3.1.2 Company information

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

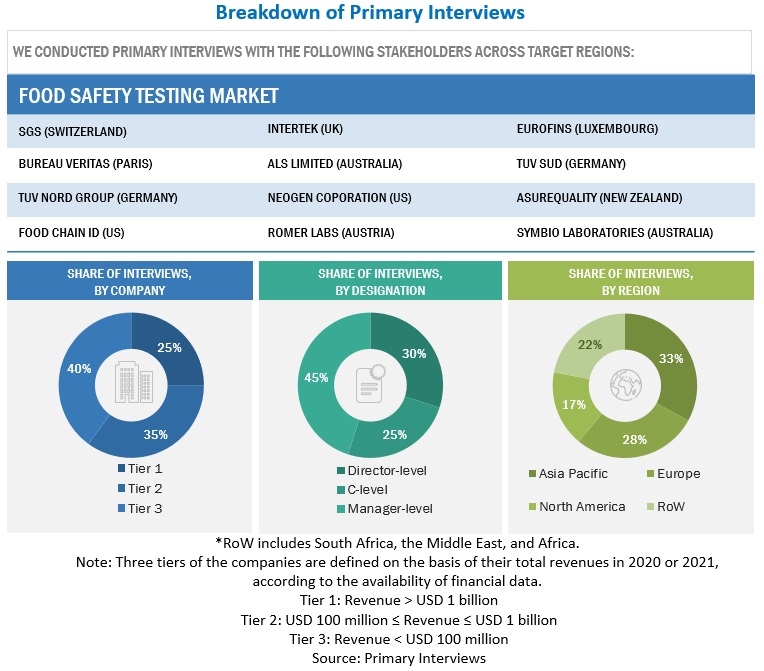

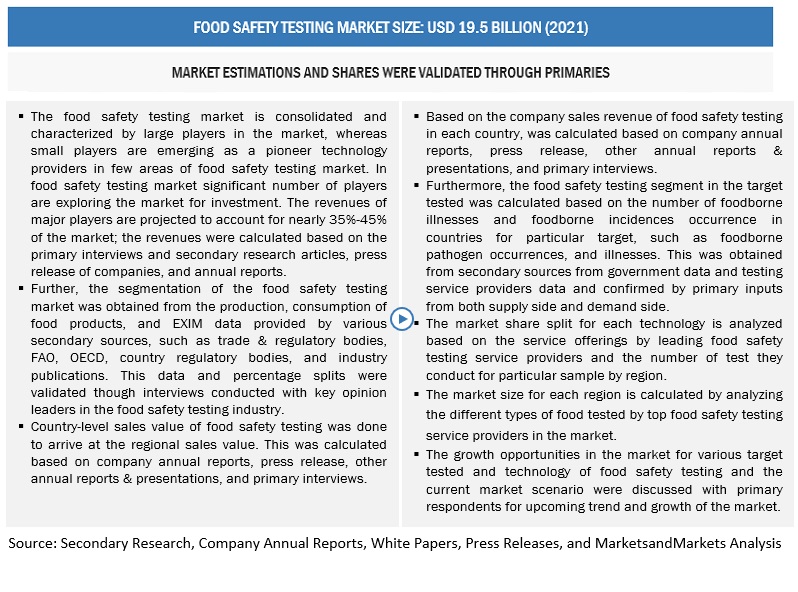

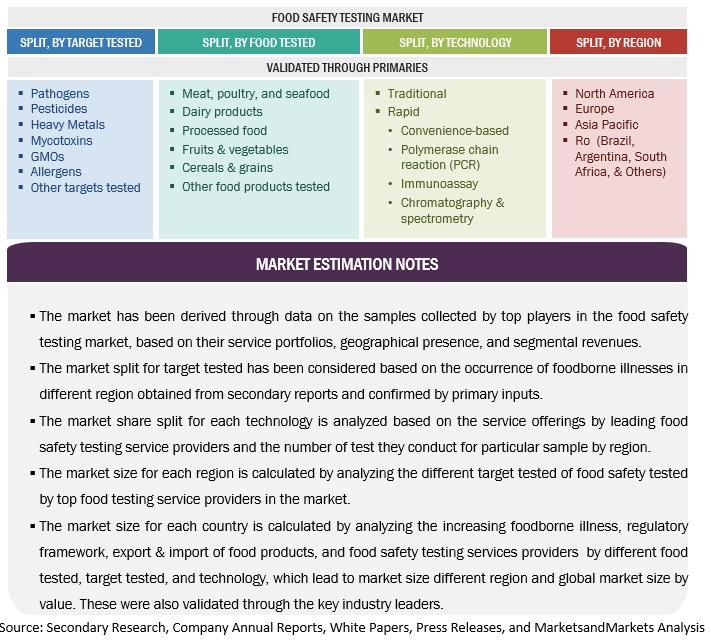

The study involved four major steps in estimating the size of the food safety testing market. Exhaustive secondary research was done to collect information on the market, as well as the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources, such as the Food and Drug Administration (FDA), United States Department of Agriculture (USDA), Centers for Disease Control and Prevention (CDC), European Food Safety Authority (EFSA), European Federation of National Associations of Measurement, Testing and Analytical Laboratories (EUROLAB), and Food Standards Australia New Zealand (FSANZ), and academic references pertaining to food safety testing were referred to identify and collect information for this study. The secondary sources also included seaweeds manufacturers’ annual reports, press releases, and investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and paid databases.

Secondary research was mainly conducted to obtain critical information about the industry’s supply chain, the total pool of key players, market classification & segmentation according to the industry trends to the bottom-most level, and geographical markets. It was also used to obtain information about the key developments from a market-oriented perspective

Primary Research

The market comprises several stakeholders in the supply chain, which include technology suppliers, food testing providers, and end-user companies. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

The primary interviewees from the supply-side include food safety testing manufacturers. The primary sources from the demand-side include distributors, importers, exporters, and end-use sectors.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the total size of the food safety testing market. These approaches have also been used extensively to determine the size of the various sub-segments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and market have been identified through extensive secondary research.

- The food safety testing value chain and market size in terms of value have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All macroeconomic and microeconomic factors affecting the growth of the food safety testing market were considered while estimating the market size.

- All the possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

The following sections (bottom-up & top-down) depict the overall market size estimation process employed for the purpose of this study.

Bottom-Up

- With the bottom-up approach, food safety testing for target testing, food tested, technology, and region were added up to arrive at the global and regional market size and CAGR.

- The bottom-up procedure has been employed to arrive at the overall size of the food safety testing market from the revenues of key players (companies) and their product share in the market.

- The market share was then estimated for each company to verify the revenue share used earlier in the bottom-up procedure. With the data triangulation procedure and data validation through primaries, the exact values of the overall parent and each market have been determined and confirmed in this study. The data triangulation procedure implemented for this study is explained in the next section.

To know about the assumptions considered for the study, Request for Free Sample Report

Top-Down

The top-down approach, the overall market size was used to estimate the size of individual markets (target tested, food tested, technology, and region) through percentage splits from secondary and primary research. To calculate each specific market segment, the most appropriate and immediate parent market size was used to implement the top-down approach. The data obtained was further validated by conducting primary interviews with industry experts, key suppliers, and manufacturers of food safety testing in the market.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation & market breakdown procedures have been employed wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market size has been validated using both the top-down and bottom-up approaches.

Report Objectives

Market Intelligence

- Determining and projecting the size of the food safety testing market with respect to target tested, technology, food tested, and region, over a five-year period, ranging from 2022 to 2027

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across the key regions

- Analyzing the demand-side factors on the basis of the following:

- Impact of macro- and micro-economic factors on the market

- Shifts in demand patterns across different subsegments and regions

Competitive Intelligence

- Identifying and profiling the key market players in the food safety testing market

- Determining the market share of key players operating in the food safety testing market

- Providing a comparative analysis of the market leaders on the basis of the following:

- Service offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions

- Providing insights on the trade scenario

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific scientific needs.

The following customization options are available for the report:

Segment Analysis

- A further breakdown of food safety testing in the sample tested.

Geographic Analysis

- A further breakdown and customization are available for the South American food safety testing market, by key countries such as Colombia, Venezuela, and Peru.

- Further analysis of the South American market can be included in the market analysis for food safety testing.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Food Safety Testing Market